&&&&

The first question is to ask "How do Guelph's taxes compare to the other levels of government?"

Let me start by trying to come up with an average tax bill in Guelph. According to the Municipal Property Assessment Corporation (MPAC), the average home in Guelph has an assessed value of $399,000. In 2017, the residential tax rate (ie: the Municipal taxes plus the special Infrastructure Levy, but not including the education rate---which Council has no control over), was 1.022948%. Multiply the assessed value of your home by this percentage (the "mill rate"), and you get $4906. (I would have much rather had a median assessed value of a Guelph home, but I couldn't find that number. The problem with average anything to do with money is that our society is becoming so stratified according to wealth that a very small number of hyper rich individuals can draw up an average and give casual observers the idea that most people are a lot better off than they really are. One Bill Gates or Warren Buffet added to the mix can draw up the average income of an awful lot of people making minimum wage at fast food restaurants.)

OK, let's look at the median household income for Ontario, which was $81,480 in 2015. That means that if a family earning the median paid the average Guelph property taxes (for the city, not the school board), $4906, that works out to about 6% of a family's income going to city taxes. Now let's see what that household would be paying in federal income taxes. First, let's assume that there are two people bringing equal amounts of money into the household. That means that each person is making $40,740. Now let's look at the federal income tax rates, which in 2017 said that people making under $46,000 had to pay 15% of their income. Next, let's look at the provincial income tax, which says that people making less than $42,000 have to pay 5%. This means that the average Guelph citizen pays 20% in taxes to the federal and provincial governments, which for my hypothetical median couple, comes to $16,300.

So through all that dubious, "back of the envelope" math, it turns out that we pay slightly more in city taxes than we do for the province. But we certainly pay a lot less money to the city than the Federal government. (This is generally true, but be careful about specific numbers---the federal government also transfers revenue from it's slice of the tax pie to the provincial government. But if I tried to figure that out in detail, we'd be so far out "in the weeds" that I'd end up writing War and Peace.)

&&&&

The second question I'll answer is "How are the taxes assessed?"

The mass media report primarily on the federal and to a lesser degree, provincial. So many people vaguely assume that the local tax system is like those others. It is actually very different. Ottawa and Queen's Park start from revenue---what rates are people going to be taxed---and then develop a budget around that. This is how it has to be because they both raise their revenue through a combination of income tax and a Value Added Tax (VAT), which Canada calls the "Goods and Services Tax".

These two sources of income fluctuate quite substantially over the country's economic ups and downs because people's incomes fluctuate based on employment. And the amount that they buy also changes due to their income. Moreover, what the government spends also fluctuates in the opposite direction---as more people get laid off and stop paying taxes, they also tend to need more government services to support them during this "down time". Because of these two tendencies, both federal and provincial governments are forced to borrow money---at least some of the time---in order to navigate the up and down of what economists call "the business cycle".

Under Ontario law municipalities are not allowed to levy either sales or income tax. Nor are they allowed to run an operating deficit (except under extremely limited circumstances.) This means that they have to calculate tax rates very differently. What they do is decide how much the city is going to spend over a given year, then they divide that by the value of the total stock of property in the city. The resulting figure is known as the "Mill rate". When you get your bill, you get a statement that says that your property is assessed as being worth so many dollars, this is multiplied by the Mill rate, and, that ends up being your bill.

As you might imagine, the assessed value of your home has a big impact on how much property tax is paid. This means that it's important that a standard, impartial mechanism is used to come up with that number. Each city used to do this for itself, but in 1970 a provincial system was put into place that municipalities could use to assess the value of each person's home. This was voluntary, however, and some municipalities continued to use their own unique system to evaluate the value of homes. In 1997, the province created a mandatory system called the "Fair Municipal Finance Act". The next year, the government created a stand-alone, non-profit corporation titled "the Ontario Property Assessment Corporation", which eventually changed its name to "the Municipal Property Assessment Corporation (MPAC)".

&&&&

This property assessment issue is something to really think about. That's because for tax purposes the important issue isn't how much your house is worth, but how quickly it's increasing in value compared to other homes in the municipality. This is because the increase in value for a home is supposed to be revenue neutral. That is to say, if every home in the city goes up by a uniform 10% in one particular year, the share that each home owner pays for the city budget will still be the same. If the budget is the same in that year as the year before---and no new taxpayers have been added to the rolls, or, old ones subtracted---then each household will pay the same tax. But, if your home alone goes up by 20% and everyone else's only goes up by 10%, your taxes will increase---because your house now is a greater part of the total value of the real estate in the city. Moreover, if your house only increases by 5% and everyone else's goes up by 10%, that means that your taxes will decrease.

If you have trouble following this, here's a video from MPAC that explains what is going on in a different way:

The issue that people now need to consider is the first law of home sales "Location, location, location". Remember this graphic from a previous article I posted? (You can click on it to get a larger view.)

This map shows the relative property values of real estate in the city of Guelph, based on their geographic location. As you can see, where your property is has an enormous impact on how much your property is worth. Buildings in the downtown core are worth a lot more money than ones in the periphery of the city. Moreover, I would suggest that they have dramatically increased in value---faster than similar buildings in other parts of the city. (I can attest to this myself, I have a modest home in the downtown and it is well on the way to quadrupling in value over only 20 years---a 15% rate of return on my initial investment. I am anticipating an interesting tax bill when MPAC gets around to re-assessing my property value.) When I hear people complaining bitterly about how much their property taxes have increased, I wonder if at least some of them are people who---like me---have had their homes increase in value a lot more than their friends, and don't understand that that is why their taxes have gone up, not because of excessive spending at city hall.

&&&&

The next question to answer is "How do Guelph Taxes compare to other municipalities?" To understand this, it's important to realize that the specific tax rate doesn't compare across municipalities. As I pointed out in the above, that is calculated by dividing the budget by the total real estate value of the city. In a city with a really hot market, the tax rate can keep dropping while at the same time the actual taxes paid can stay the same or go up. In a city with a stagnant market, the rate can be high but the actual taxes paid can be less than another city that has a very low tax rate.

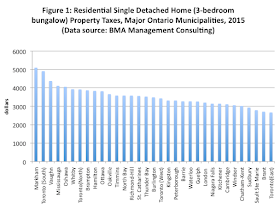

To get a real feel for how taxes compare across municipalities it makes more sense to compare the specific taxes on one type of home across different municipalities. Luckily, (may the Dark Lord of the North forgive me for saying so) the Fraser Institute has published a paper where an economist actually did this. These are the results that Livio Di Matteo from Lake Head University came up with. As he describes in the paper,

"The basis for comparison is a detached three-bedroom single-storey home with 1.5 bathrooms and one-car garage with a total house area of approximately 1,200 square feet on a lot approximately 5,500 square feet."(As usual, click on the graph to get a bigger, easier to read, version.)

|

| From Fraser Forum, "Ontarians face growing property tax burden in many municipalities", by Livio Di Matteo |

As you can see, Guelph is in the lower end of the graph---between Waterloo and London---with taxes of a bit above $3000 for Matteo's hypothetical suburban home.

Personally, I find this somewhat surprising. Guelph is one of the fastest growing cities in Ontario, with a population increase of 7.7% since 2011, which is much higher than the Ontario average of 4.6%. This creates all sorts of "scaling problems" for the city as it tries to play "catch up" with infrastructure that was designed for a smaller population by building new stuff (like the new police station) that has to be big enough for what the population is going to be decades from now.

There is another graph in the paper, however, that makes more sense given this context.

|

| "Ontarians face growing property tax burden in many municipalities" |

This is the rate at which property taxes are growing in various Ontario municipalities. Guelph is the fourth highest, whereas Waterloo and London are the sixth and fourth lowest, respectively. This increase in the rate of taxes seems to indicate that Guelph is trying to play "catch up" in its taxation and move from the lowest third in the previous graph towards a higher taxation rate. This is why people might perceive Guelph taxes as being very high, even though they are less than the average.

But having said that, why are Guelph's rates going up so fast? I mentioned the scaling issue above, and why it costs a city a lot of money to grow really fast. And if you look at the latest numbers from the federal census, you can see that Guelph has had a rate of 7.7% growth since 2011, whereas London and Waterloo (which had comparable tax rates in 2016) had a population growth of 4.1% and 5.5%, respectively.

Of course, no one wants their taxes to increase dramatically, but the questions voters should be asking are "Why are the taxes going up so fast?", and, "Is this rapid increase a temporary trend? Or something that will continue indefinitely?" Looking at the information that I've posted above, I'd argue that the rapid increase is an attempt to "catch up" to a more logical tax rate---giving the extended period of rapid growth the city is going through. And that once we do that, the period of rapid growth in taxes will probably stop.

&&&&

Lately I've been talking to various people about this magazine. I'm trying to figure out how to make it into something that people will find easier to access and read. I haven't been getting a lot of complaints about the content, but I have heard some negative feedback about the design. On the basis of these, I'm going to explain a few things that people are missing.

First, several people said that they weren't finding out when new stories were being posted. These are people who aren't on FaceBook or Twitter---and have zero interest in doing so. I've found out that the majority of these people simply don't know what an "RSS Feed" is, and frankly, have zero interest in learning. I think that that's too bad, because this is a really good way to learn about new issues of blogs that you want to read. But I've learned that while it probably isn't true that "the customer is always right", there's no profit in arguing with them.

As a result, I've added another feature to the blog. If you look at the right hand string of links on this site, between the heading "search this blog" and "subscribe", there is now a new option of "follow by email". All you have to do is add an email address, answer a simple question to prove you aren't a spam bot, and, you will have a link sent to your email address.

Another person said that he hates reading stuff off a screen and would rather read a hard copy. If you are one of these people, then look at the bottom of this article and look to see if you notice a little button that says "print friendly". (I don't know why, but it doesn't seem to show up all the time for me, but it is usually there.) If it is there, you can click on it to see the article reformatted to remove all the advertising and other features that are extraneous to the article in question. At the top of the screen, you have the option of either printing it directly, or, making it into a PDF file that you can save and then print off. Moreover, I intend to reprint these articles in a book format before the next municipal election---primarily so people can buy copies to give to their angry relatives who spend too much time reading other blogs that put great effort into attacking local politicians and city staff.

Finally, I got the response from a local business person I was trying to hit up for an advert that the site is too "stodgy". My wife has made the same comment and is after me to move from Blogger to some other blog hosting platform. The thing for me, however, is that Blogger is free and these other sites cost money. They also require a lot more work to design and maintain, so I'm wary of taking on something that will cost both more money and time. All I can say about this is that if you want to get a more visually pleasing magazine, people are going to have to pay for it.

Which gets me to the usual blue type plea for support. A lot of young people simply won't pay for anything on the Internet---they expect their music, their movies, and their news for free. I don't know where they expect this stuff comes from, but a lot of young people are getting the short end of the stick in this economy, so I'll cut them some slack. That leaves boomers like me, who, on average, are in a much better financial shape. Most of us are used to paying for a local newspaper, magazines, etc. Why not pony up a buck a month to a Patreon subscription to allow me to do things like get a better blogger platform?

&&&&

Now I'm going to raise a couple issues that will probably result in some very angry reactions. If I was a "real journalist", my editor would never let me mention them in an article. But if my readers aren't going to pay me more than a pittance, well, then I guess I don't have to pander to them, do I? ;-)

Consider this graphic. (And yes, if you can't read the fine print, click on it for a bigger version.)

|

| Graphic from the blog "5 Kids, 1 Condo", used under the "fair use" copyright rule. Original graphic from the Wall Street Journal. |

The main point I want to illustrate is that around the end of WWII the average US home size was under 1,000 square feet and the average family consisted of 3.37 people, whereas in the late 1980s this had changed to a little under 2500 square feet for 2.53. In other words, home size has more than doubled at the same time that the average number of people living in it has declined by 25%. (The Canadian situation isn't exactly the same, but close enough that I think that similar forces are at work---especially in Southern Ontario.)

The period of time between the end of WW2 and the 2008 economic collapse was a bizarre time to be a resident of North America. The industrial powerhouses in Europe and Asia were smoking piles of rubble, which meant that there was a tremendous need for the output of American and Canadian factories. In addition, the agricultural systems of most nations outside of the New world were in chaos due to either war damage, colonies fighting for independence, or, civil wars. This meant that farmers could get top dollar for their cereal crops---no matter what quality. It was as if the fleets of heavy bombers from the war had decided to bomb Canada and the US with money instead of ordinance.

In these "fat decades" whole generations of people got used to living in ways that would have astounded their grandparents. Fortunately for the rest of the world, damaged machinery got replaced and other nations started being able to make stuff again. And countries that had suffered from starvation enacted policies to ensure that they would never again be dependent on imported food. This all cut into the huge advantage that North America had over the rest of the world, and started to force us to learn how to compete with Europe, China, India, Japan, etc. The "fat years" went on a diet.

In these "fat decades" whole generations of people got used to living in ways that would have astounded their grandparents. Fortunately for the rest of the world, damaged machinery got replaced and other nations started being able to make stuff again. And countries that had suffered from starvation enacted policies to ensure that they would never again be dependent on imported food. This all cut into the huge advantage that North America had over the rest of the world, and started to force us to learn how to compete with Europe, China, India, Japan, etc. The "fat years" went on a diet.

At the same time that North Americans were getting used to being rich, a whole new set of costs were added to the economy. We started putting a price on pollution for the first time, which added to the cost of business. We also started funding social programs instead of just ignoring the poor---this also cut away at the bottom line. A whole raft of things like pensions, medical coverage, drug benefits, welfare, job training programs, childcare, etc, popped up and started fighting for some of the public pie. At the same time, unfortunately, cities decided to ignore the importance of things like density and public transit. (I've talked in detail about these issues in articles about the Places to Grow Act, the OMB, and, the real cost of parking.) This increased the frontage of roads, sewers, water lines, electricity lines, etc, per taxpayer and dramatically increased the cost of maintaining a city. All of these seemed like "just a little more" during the fat years, but started to weigh tax payers down when competition from Europe and Asia started to be a "thing".

What this all means is that for generations people in North America (and Guelph) have gotten used to being so well off that they never really had to think much about the real cost of various aspects of life. But now things are different. We simply cannot build anymore suburban sprawl if we want to have any farmland or potable water left in the province. This means that the vast majority of young people simply cannot afford to buy the sort of homes that their parents live in. Even worse, because of global competition with the newly rebuilt industrial powerhouses in Europe and Asia, business has become insanely competitive---which has totally redefined work. Increasingly, young people have to get by through stitching together a bunch of crappy, poorly-paid, precarious jobs.

What is happening is we are facing a tremendous decline in the wealth available to live something approaching the lifestyle of a middle-class suburban family of the 1960s. This isn't just a Guelph thing---it's happening all over the world. And anyone who's response isn't to adapt to the new circumstances is going to suffer badly as they try to "force" the world to go back to the way it was before. IMHO, that's what is fueling the support for tremendously counter-productive political tendencies. People who support Donald Trump really want to "Make America Great Again". And people voting for Rob Ford wanted to "End the war on the car". I'm sure that people who voted for the Brexit wanted to see Great Britain go back to the "good old days" of the Empire.

The problem is, however, that the "good old days" aren't coming back. First of all, the problems that governments like Guelph are facing aren't just attempts at "Marxist social engineering". Climate change, sprawl, and the other issues I've mentioned in previous articles, aren't fantasies dreamed up in a university seminar---they are real problems. And the economies of Europe and Asia are objectively real, and they are competing head-to-head with us. We simply cannot "wish" China, India, Japan, the EU, and Korea away.

Things aren't all bad, however. By any objective standard, Canada is far wealthier that it was when I was born. Even with the present's ridiculously unequal distribution of wealth, even the poor are far better off than they were during the 1930s. Women, gays, the First Nations, people of colour, etc, are all participating in society in ways that would have been thought impossible during the 1950s. Even more importantly, there is every indication that this progress will not only be preserved by will even accelerate. But having said all of that, people are going to have to become innurred to living in smaller homes in far more dense neighbourhoods. And they are also going to have to pay more money in property taxes in order to preserve the city we live in. If you cannot afford to pay the taxes on your present home, maybe you should cash out it's accumulated value and live somewhere cheaper. If you find you can still afford it, then perhaps you should just stop complaining and be greatful that for all the problems facing us, we still live in the most peaceful, prosperous, and just time in human history. There are still a lot of people who cannot afford to own any sort of home at all, and they are worse off than you. Be grateful that you have the priviledge of paying property taxes---lots of people will never do so as long as they live.

What this all means is that for generations people in North America (and Guelph) have gotten used to being so well off that they never really had to think much about the real cost of various aspects of life. But now things are different. We simply cannot build anymore suburban sprawl if we want to have any farmland or potable water left in the province. This means that the vast majority of young people simply cannot afford to buy the sort of homes that their parents live in. Even worse, because of global competition with the newly rebuilt industrial powerhouses in Europe and Asia, business has become insanely competitive---which has totally redefined work. Increasingly, young people have to get by through stitching together a bunch of crappy, poorly-paid, precarious jobs.

What is happening is we are facing a tremendous decline in the wealth available to live something approaching the lifestyle of a middle-class suburban family of the 1960s. This isn't just a Guelph thing---it's happening all over the world. And anyone who's response isn't to adapt to the new circumstances is going to suffer badly as they try to "force" the world to go back to the way it was before. IMHO, that's what is fueling the support for tremendously counter-productive political tendencies. People who support Donald Trump really want to "Make America Great Again". And people voting for Rob Ford wanted to "End the war on the car". I'm sure that people who voted for the Brexit wanted to see Great Britain go back to the "good old days" of the Empire.

The problem is, however, that the "good old days" aren't coming back. First of all, the problems that governments like Guelph are facing aren't just attempts at "Marxist social engineering". Climate change, sprawl, and the other issues I've mentioned in previous articles, aren't fantasies dreamed up in a university seminar---they are real problems. And the economies of Europe and Asia are objectively real, and they are competing head-to-head with us. We simply cannot "wish" China, India, Japan, the EU, and Korea away.

Things aren't all bad, however. By any objective standard, Canada is far wealthier that it was when I was born. Even with the present's ridiculously unequal distribution of wealth, even the poor are far better off than they were during the 1930s. Women, gays, the First Nations, people of colour, etc, are all participating in society in ways that would have been thought impossible during the 1950s. Even more importantly, there is every indication that this progress will not only be preserved by will even accelerate. But having said all of that, people are going to have to become innurred to living in smaller homes in far more dense neighbourhoods. And they are also going to have to pay more money in property taxes in order to preserve the city we live in. If you cannot afford to pay the taxes on your present home, maybe you should cash out it's accumulated value and live somewhere cheaper. If you find you can still afford it, then perhaps you should just stop complaining and be greatful that for all the problems facing us, we still live in the most peaceful, prosperous, and just time in human history. There are still a lot of people who cannot afford to own any sort of home at all, and they are worse off than you. Be grateful that you have the priviledge of paying property taxes---lots of people will never do so as long as they live.

"Be grateful that you have the priviledge of paying property taxes---lots of people will never do so as long as they live. " Hi Bill. Good article. Just one thing with the last line: if you rent you also pay property tax. Indirectly, sure. But you still do. Which is why all *citizens* of Guelph have a right to the services the City offers. Not just the property owners like you and I.

ReplyDeleteYes. Quite right. In fact, renters actually pay a higher property tax rate than home owners. (Although this doesn't necessarily translate into higher taxes, per ce. Lots of complex math involved there.) I had thought about mentioning this in the article, but I've been repeatedly told not to let the length get out of hand, so I've been working on shortening what I write.

Delete